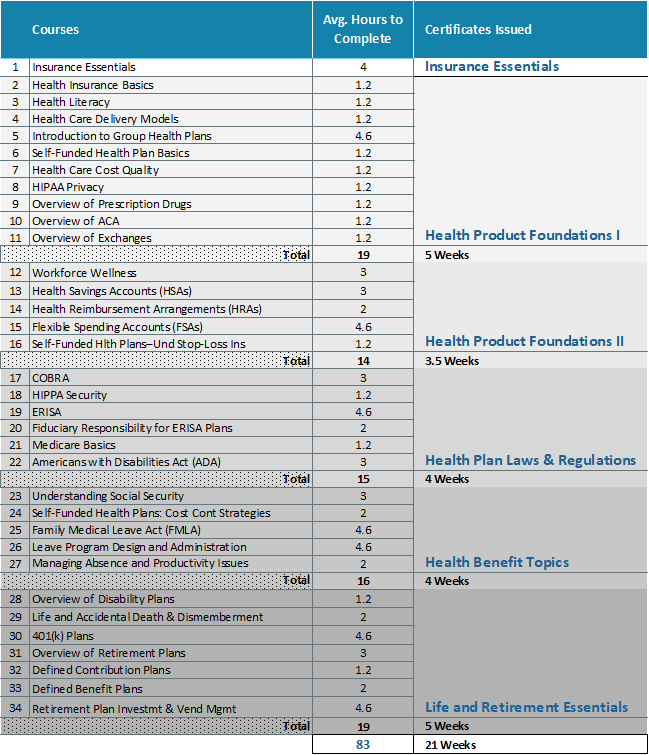

CRMG SERVICE

CISR (Certified Insurance Service Representative)

The Certified Insurance Service Representatives (CISR) designation program is a nationally recognized educational program for customer service representatives. This practical program includes 9 courses focused on minimizing E&O claims and understanding and analysis of risks and exposures. Some working knowledge of the applicable policies is required.

ACSR (Accredited Customer Service Representative)

Take your career further by deepening your knowledge of insurance products and building your client-centric skillset. Achieve these goals and more as you earn Micro-Certs and The Institutes Designations Accredited Customer Service Representative™ (ACSR™).

Program highlights:

- 2 courses, 3 Micro-Certs, plus ethics

- 4-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

CIC (Certified Insurance Counselor)

The Certified Insurance Counselor program is nationally recognized and highly respected insurance professional designation for agency owners, producers, agents, CSR’s, brokers, and insurance company personnel.

CRIS (Construction Risk and Insurance Specialist)

The Construction Risk and Insurance Specialist (CRIS®) continuing education (CE) program provides insurance agents, brokers, CSRs, and in-house risk managers or insurance buyers specialized expertise in construction insurance and risk management. Obtaining the CRIS certification will increase the competence, confidence, and credibility of insurance professionals who sell or underwrite insurance for contractors.

OSHA Certification

OSHA’s Safety and Health Fundamentals Certificate program support’s OSHA’s mission by training public and private sector employees in occupational safety and health to reduce incident rates for workers. Participants have the opportunity to earn certificates for Construction, Maritime, and General Industry training.

Participants can choose from a variety of topics such as occupational safety and health standards, safety and health management, incident investigation, fall hazard awareness, and recordkeeping. Courses are available at OSHA Training Institute (OTI) Education Centers nationwide.

MLIS (Management Liability Insurance Specialist)

The Management Liability Insurance Specialist (MLIS®) certification showcases your specialized expertise in all aspects of professional liability insurance including directors and officers (D&O) liability, employment practices liability (EPL), fiduciary liability, and cyber exposures.

AIC-M (Associate in Claims – Management)

Gain on-the-job claims skills and prepare for your next opportunity with The Institutes Designations AIC.

Gain on-the-job skills you can use right away with the AIC designation. Program details include:

- 3 courses, plus ethics + Management Course

- 9-12 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

With just one more course, you can gain valuable leadership skills to effectively manage a claims team.

ARM (Associate in Risk Management)

Make a real-world impact by gaining a holistic and strategic understanding of risk assessment and treatment with The Institutes Designations ARM.

Gain skills you can use right away with the ARM designation. This program includes:

- 3 courses, plus ethics

- 9–12 month completion time

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

CRM (Certified Risk Manager)

Risk Managers don’t leave anything to chance! Participate in the program that gives you a dependable advantage in the demanding field of risk management—the CRM Program.

Risk management is one of the many responsibilities of a variety of professionals, including accountants, attorneys, financial and insurance professionals, and specialists in loss control. If you are one of these practitioners, you may be ready to take courses or pursue your CRM designation.

You’ll benefit from attending CRM courses—gaining expertise and credibility with your organization and in the risk management community.

Earning the CRM designation demonstrates your expertise and shows that you are a part of an international network of respected and dedicated risk management professionals.

CPCU (Chartered Property Casualty Underwriter)

Gain skills you can use right away with the CPCU designation. This program includes:

- 8 courses, plus ethics

- 18-24 months to complete

- 100% online courses

- Virtual exams for all courses

- Matriculation requirement

- Mailed diploma upon completion

- Ongoing continuing education

CRMG SALES

PRC (Professional Risk Consultant)

Earning the Professional Risk Consultant™ (PRC) designation illustrates to your prospects and leaders that you are dedicated to serving your clients, staying current on trends and updates, and are in control of your future as a respected and in-demand producer.

Courses and Micro-Certs include:

- Video lessons as short as 5 minutes

- Keeping it Real segments featuring veteran producers and risk managers

- Quizzes

- Interactive Activities

- Flashcards

- Simulated Exam Prep

AAI (Accredited Adviser in Insurance)

Establishing yourself as a leader in the insurance industry takes dedication, strong skills, and a solid knowledge base. Build your skills and knowledge as you build your business – and future with The Institutes Designations AAI.

Program highlights:

- 3 courses, plus ethics

- 3-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

ARM (Associate in Risk Management)

Make a real-world impact by gaining a holistic and strategic understanding of risk assessment and treatment with The Institutes Designations ARM.

Gain skills you can use right away with the ARM designation. This program includes:

- 3 courses, plus ethics

- 9–12 month completion time

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

CIC (Certified Insurance Counselor)

The Certified Insurance Counselor program is nationally recognized and highly respected insurance professional designation for agency owners, producers, agents, CSR’s, brokers, and insurance company personnel.

CRIS (Construction Risk and Insurance Specialist)

The Construction Risk and Insurance Specialist (CRIS®) continuing education (CE) program provides insurance agents, brokers, CSRs, and in-house risk managers or insurance buyers specialized expertise in construction insurance and risk management. Obtaining the CRIS certification will increase the competence, confidence, and credibility of insurance professionals who sell or underwrite insurance for contractors.

TRIP (Transportation Risk and Insurance Specialist)

Understand the transportation and logistics industry and its risks with courses including motor carrier liability coverage, cargo risks and insurance, and workers compensation for the transportation industry.

MLIS (Management Liability Insurance Specialist)

The Management Liability Insurance Specialist (MLIS®) certification showcases your specialized expertise in all aspects of professional liability insurance including directors and officers (D&O) liability, employment practices liability (EPL), fiduciary liability, and cyber exposures.

ERIS (Energy Risk and Insurance Specialist)

Understand the oil and gas industry and its risks with courses including commercial liability for the energy industry, contractual risk transfer in energy, control of well/operators extra expense, and workers compensation and maritime liability.

AFIS (Agribusiness and Farmin Insurance Specialist)

Master the nuances of agribusiness and farm risks and insurance with courses including farm property, farm liability, farm auto, workers compensation, and umbrella insurance.

ASFB (Associate in Fidelity and Surety Bonding): https://web.theinstitutes.org/designations/associate-fidelity-and-surety-bonding

Demonstrate your proficiency in fidelity and surety bonding with the The Institutes Designations AFSB program, developed by our industry’s most experienced professionals. The AFSB designation serves as a concrete measure of competency and knowledge of the surety industry.

- PRC – Associate Advisors / Lead Gen (within year 1)

- AAI – Associate Advisor (1-2 years)

- ARM – Associate Advisors (2-3 years)

- CIC – All Advisors through National Alliance

- Specialty Designations

- CRIS (Construction) through IRMI

- Transportation through IRMI

- Liability through IRMI

- Energy Risk through IRMI

- Agribusiness through IRMI

- AFSB (Bonding) through The Institutes

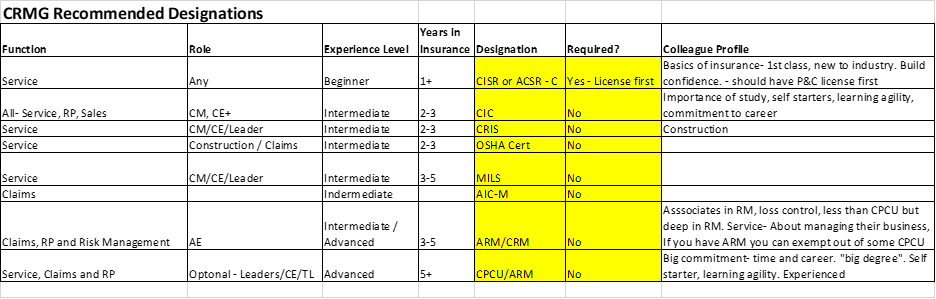

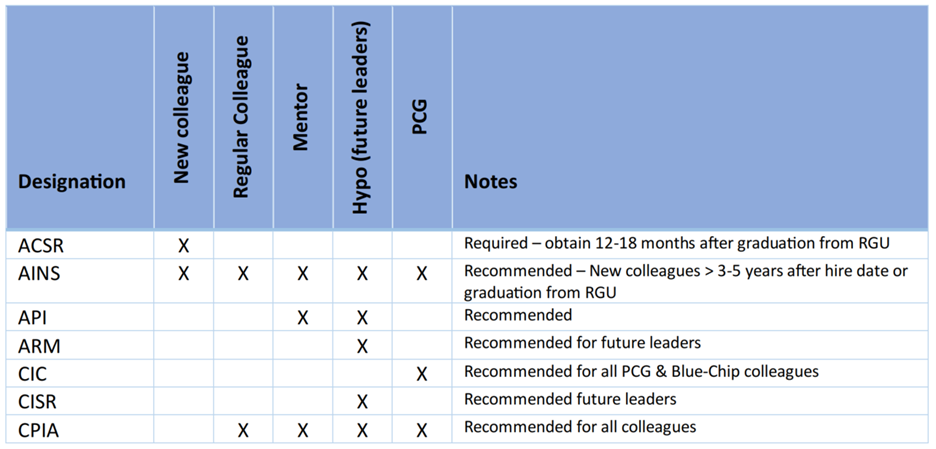

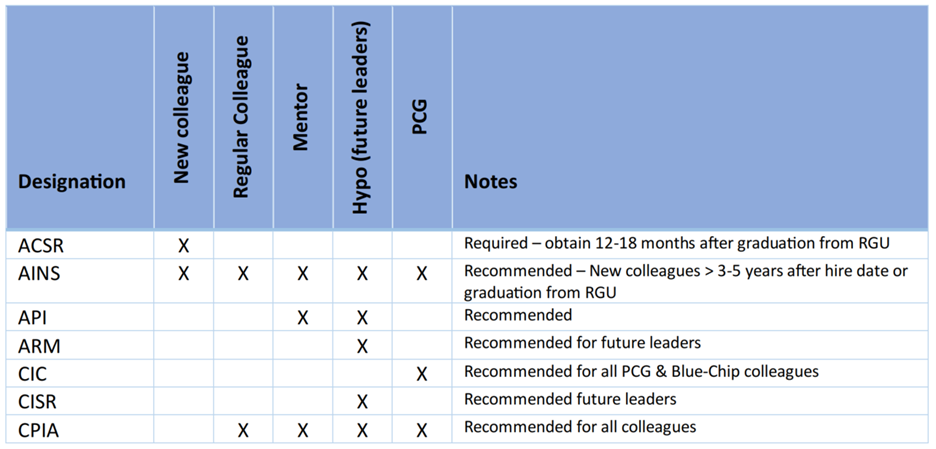

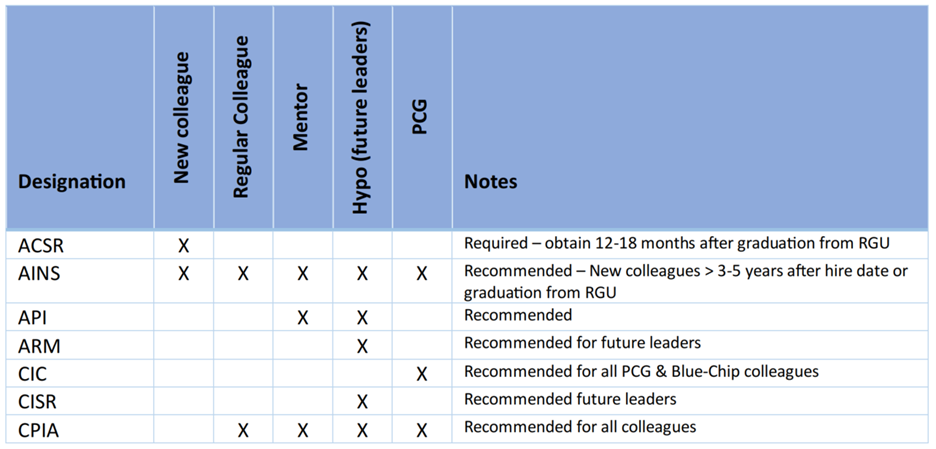

PRM SERVICE

ACSR (Accredited Customer Service Representative)

Take your career further by deepening your knowledge of insurance products and building your client-centric skillset. Achieve these goals and more as you earn Micro-Certs and The Institutes Designations Accredited Customer Service Representative™ (ACSR™).

Program highlights:

- 2 courses, 3 Micro-Certs, plus ethics

- 4-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

AINS (Associate in Insurance)

Grow your career and speak like an insurance pro in no time with The Institutes Designations Associate in Insurance (AINS®).

Gain skills you can use right away with the AINS designation. This program includes:

- 3 courses, plus ethics

- 3-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

API (Associate in Personal Insurance)

Gain a comprehensive understanding of personal insurance with The Institutes Designations API.

Gain skills you can use right away with the API designation. This program includes:

- 3-4 courses, plus ethics

- 12-18 months to complete

- Choice of two study packages

- Virtual exams for all courses

- Mailed diploma upon completion

ARM (Associate in Risk Management)

Make a real-world impact by gaining a holistic and strategic understanding of risk assessment and treatment with The Institutes Designations ARM.

Gain skills you can use right away with the ARM designation. This program includes:

- 3 courses, plus ethics

- 9–12 month completion time

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon completion

CIC (Certified Insurance Counselor)

The Certified Insurance Counselor program is nationally recognized and highly respected insurance professional designation for agency owners, producers, agents, CSR’s, brokers, and insurance company personnel.

CISR (Certified Insurance Service Representative)

The Certified Insurance Service Representatives (CISR) designation program is a nationally recognized educational program for customer service representatives. This practical program includes 9 courses focused on minimizing E&O claims and understanding and analysis of risks and exposures. Some working knowledge of the applicable policies is required.

CPIA (Certified Professional Insurance Agent)

The CPIA designation program will teach you how to build and deliver effective insurance programs, broaden your organization’s market reach, and provide customer service that drives increased retention. You will leave with expanded technical knowledge, practical ways to reduce E&O exposures, and greater confidence in your ability to serve today’s customers with what they want…and more.

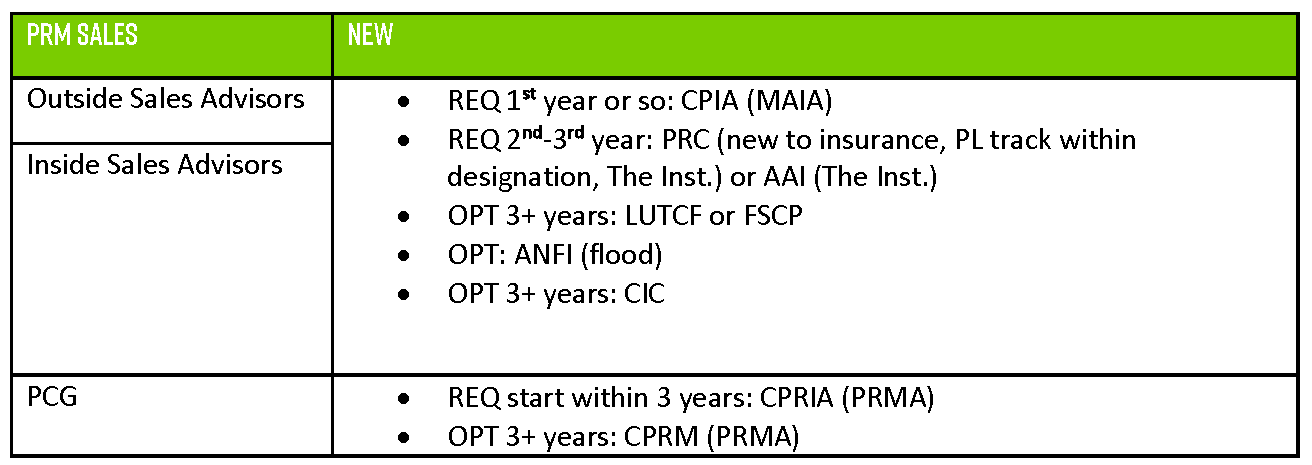

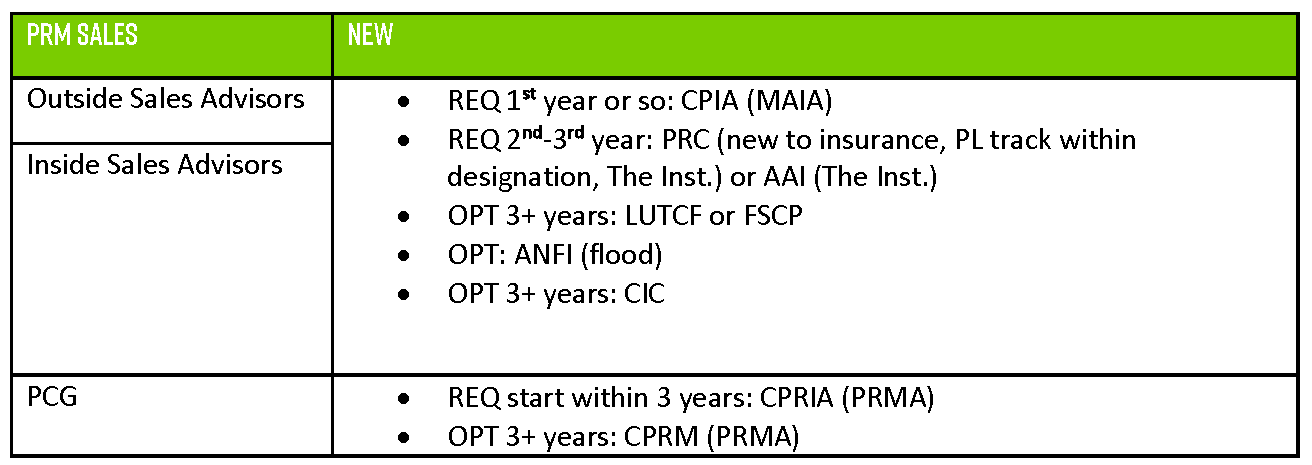

PRM SALES

CPIA (Certified Professional Insurance Agent)

The CPIA designation program will teach you how to build and deliver effective insurance programs, broaden your organization’s market reach, and provide customer service that drives increased retention. You will leave with expanded technical knowledge, practical ways to reduce E&O exposures, and greater confidence in your ability to serve today’s customers with what they want…and more.

PRC (Professional Risk Consultant)

Earning the Professional Risk Consultant™ (PRC) designation illustrates to your prospects and leaders that you are dedicated to serving your clients, staying current on trends and updates, and are in control of your future as a respected and in-demand producer.

Program highlights:

- 2 courses, 3 Micro-Certs, plus ethics

- 4-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

AAI (Accredited Adviser in Insurance)

Establishing yourself as a leader in the insurance industry takes dedication, strong skills, and a solid knowledge base. Build your skills and knowledge as you build your business – and future with The Institutes Designations AAI.

Program highlights:

- 3 courses, plus ethics

- 3-6 months to complete

- 100% online courses

- Virtual exams for all courses

- Mailed diploma upon program completion

- Digital badge upon program completion

LUTCF (Life Underwriter Training Council Fellow)

The Life Underwriter Training Council FellowSM, or LUTCF® program, is a three-course designation program for financial professionals. The College for Financial Planning®—a Kaplan Company and the National Association of Insurance and Financial Advisors (NAIFA) partnered in 2014 to create a program that focuses on the skills that the top insurance agencies feel new agents need the most.

FSCP (Financial Services Certified Professional)

The Financial Services Certified Professional® (FSCP®) designation offers the most essential product knowledge, and marketing and planning skills training available to financial services professionals today. In addition, our program flexibility allows you to set your own path as you lay the foundation for career-long learning and growth.

ANFI (Associate in National Flood Insurance)

Gain skills to confidently handle all aspects of flood insurance with ANFI, an Institutes Designation, developed in collaboration with the Federal Emergency Management Agency (FEMA).

Program details include:

- 2 courses, plus ethics

- Free online course and exam prep

- 3-6 month completion time

- Virtual exams for all courses

- Mailed diploma upon completion

CPRIA (Chartered Private Risk and Insurance Adviser)

The Chartered Private Risk and Insurance Advisor (CPRIA) certificate is the only certification program specifically developed for professionals in the high net worth industry. Endorsed by the Tobin Center for Executive Education of St. John’s University in conjunction with St. John’s School of Risk Management, Insurance and Actuarial Science, CPRIA aims to broaden your knowledge, enable you to give better advice to clients and provide you with specialized solutions to complex industry issues.

CPRM (Certified Personal Risk Manager)

The National Alliance developed this program in concert with the Council for Insuring Private Clients (CIPC), resulting in a powerful curriculum that furnishes just the right combination of risk management, technical information, and account development. You can begin to transform your career with CPRM. This first-of-its-kind high-level program is supported by top carriers from across the nation.

EBG SERVICE

Self-Funding Certification

Developed by experts in the market space, this three-hour course instruction will ensure that students understand the key technical components of self-funding and are better prepared to counsel their clients on the various benefits of elimination of most premium tax, lowering cost of administration, claims/administration and customer service for employees.

Advanced Self-Funding Certification

This five-hour course will begin with paying distinct attention to regulatory concerns, service-model options, cost-containment strategies and underwriting. Class participants will walk through unique issues that self-funded plans must face due to mergers and acquisitions followed by a concentration of study covering the integration of next-generation elements in plan design, transparency tools, quality-based models, cost-sharing and control, tool integration and incentives, and payment controls.

CEBS (Certified Employee Benefits Specialist)

CEBS puts the power in profession by providing the knowledge you need and the respect you deserve. CEBS has always provided the high-caliber knowledge you need by partnering with prestigious universities. Now you also get the application, the connections and the relationships, all career long.

REBC (Registered Employee Benefits Consultant)

Earning the Registered Employee Benefits Consultant® (REBC®) designation elevates your credibility as a professional. The field of employee benefits continues to evolve rapidly. A year does not go by without new government regulations, new or modified coverages, and new techniques for controlling benefit costs. To best serve their clients, professionals need to have a current understanding of the provisions, advantages, and limitations associated with each type of benefit or program as a method for meeting economic security. The designation program analyzes group benefits with respect to the ACA environment, contract provisions, marketing, underwriting, rate making, plan design, cost containment, and alternative funding methods. The largest portion of this program is devoted to group medical expense plans that are a major concern to employers, as well as to employees. The remainder of course requirements include electives on topics serving various markets based on a broker’s client needs.

GAB (Group Benefits Associate)

The Group Benefits Associate (GBA) designation is valuable education for those working with health and other group benefits. The courses deliver up-to-date and relevant information that provides participants with the knowledge and skills needed to understand, strategically manage, and meet the challenges of the group benefits environment.

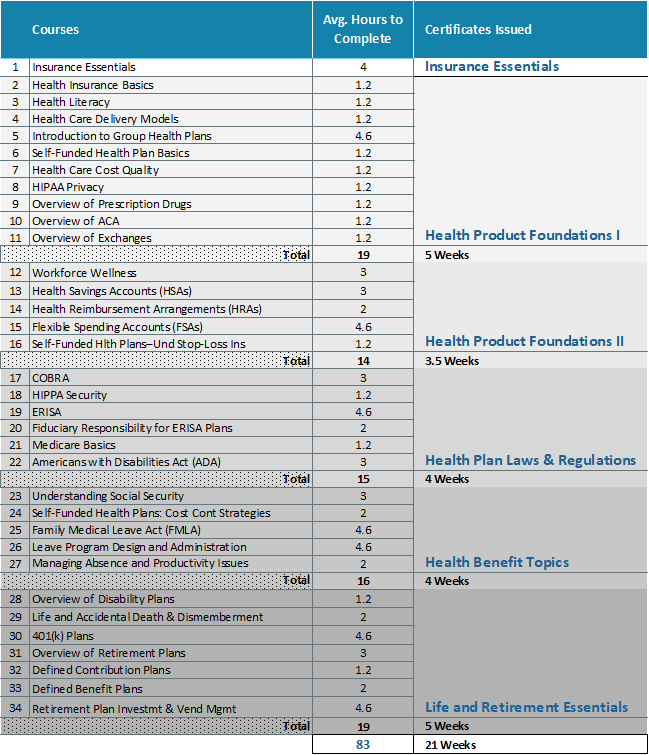

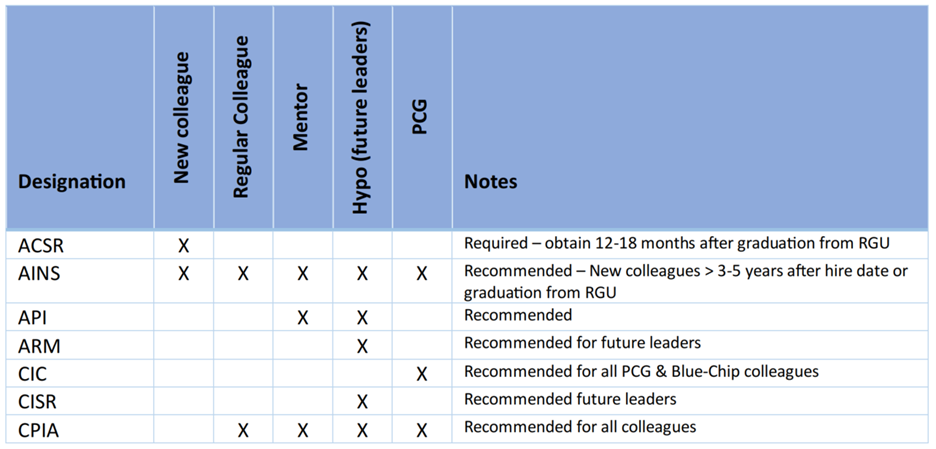

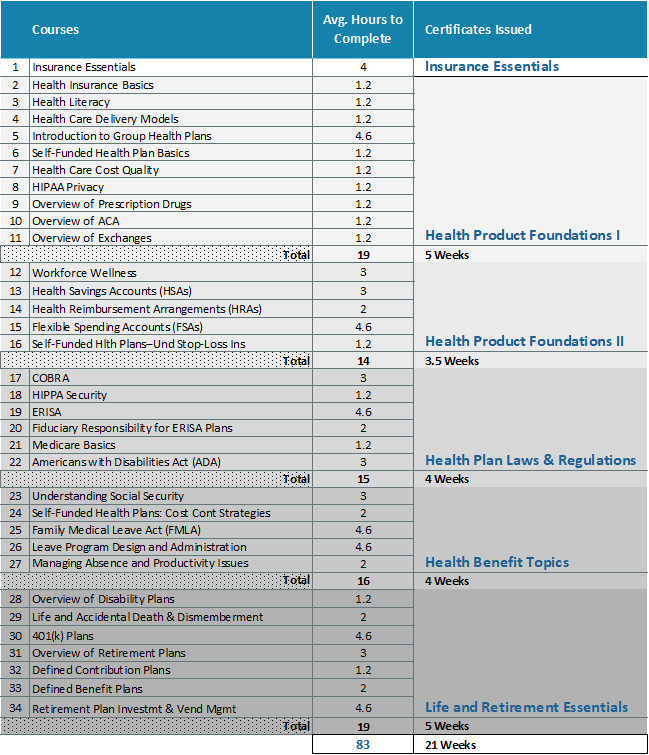

- The Institutes learning track (see attached spreadsheet, EB tab), within 1st year

- Self-Funding Certificate, within 1st 1-2 years

- Advanced Self-Funding Certificate, within 1st 1-2 years following Self-Funding Certificate

- CEBS Designation OR REBC Designation, 3-5+ years

- For additional consideration: GAB Designation

The Institutes Learning Track: https://web.theinstitutes.org/

EBG SALES

Self-Funding Certification

Developed by experts in the market space, this three-hour course instruction will ensure that students understand the key technical components of self-funding and are better prepared to counsel their clients on the various benefits of elimination of most premium tax, lowering cost of administration, claims/administration and customer service for employees.

CEBS (Certified Employee Benefits Specialist)

CEBS puts the power in profession by providing the knowledge you need and the respect you deserve. CEBS has always provided the high-caliber knowledge you need by partnering with prestigious universities. Now you also get the application, the connections and the relationships, all career long.

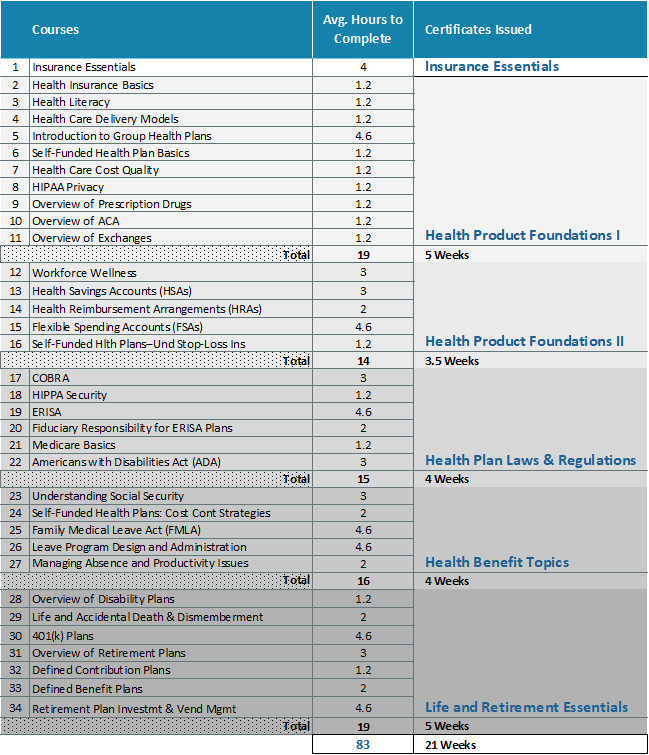

- New-to-industry/Lead Gen/Assoc Advisors: complete The Institutes learning path in the attached spreadsheet (EB tab) within the first 9 months of employment/promotion

- Assoc Adv/Newer Advisors: complete Self-Funding Certificate

- Advisors 3-5+ years: complete CEBS Designation

The Institutes Learning Track: https://web.theinstitutes.org/