What can I do to lower my homeowners insurance costs?

Homeowners rates are on the rise due to the insurance hard market. Here are some tips to help combat rising rates.

WHY ARE RATES INCREASING?

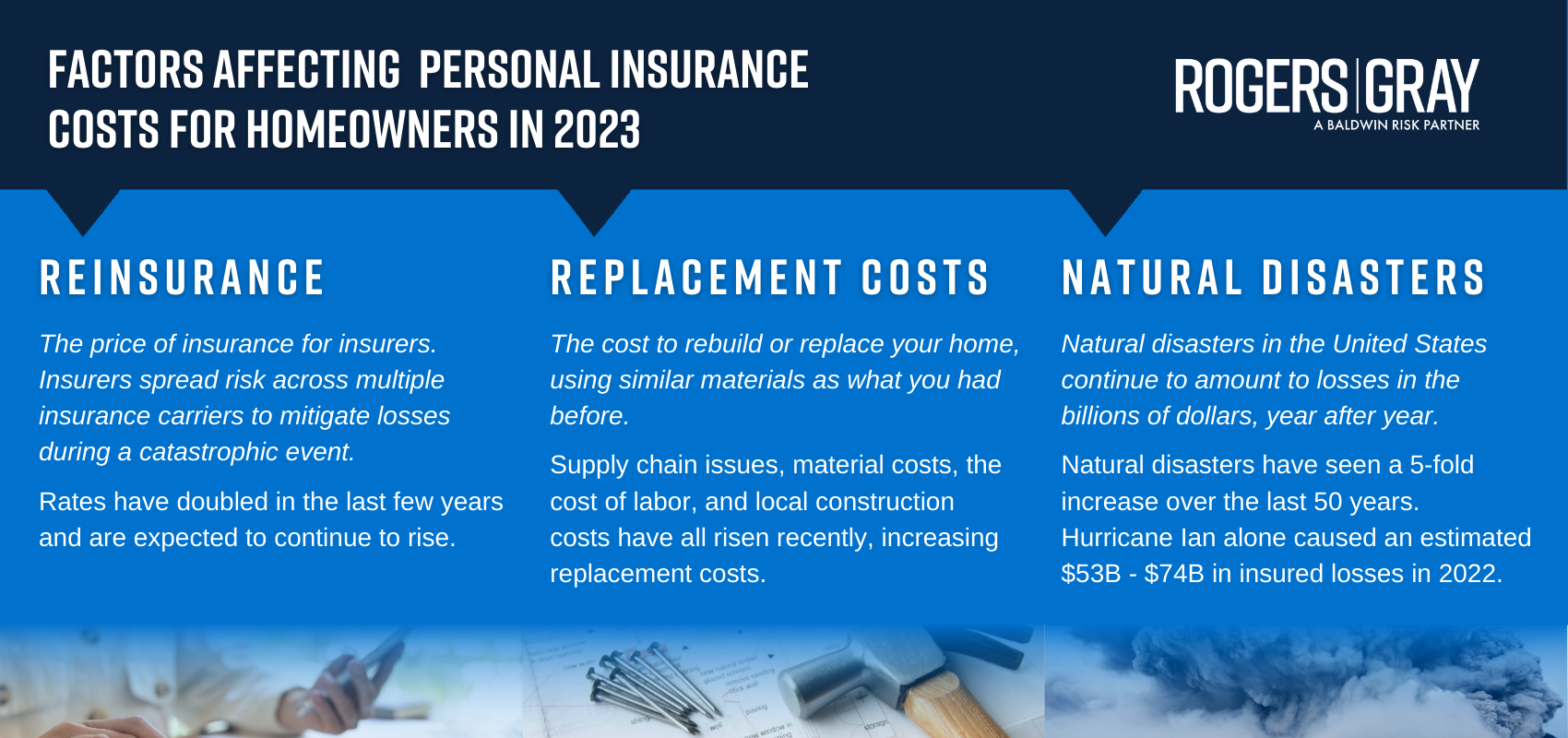

REINSURANCE

Also known as insurance for insurers.

Reinsurance is the practice whereby insurers transfer portions of their risk portfolios to other parties to reduce the likelihood of paying a large obligation resulting from large claims volume. Reinsurance gives the insurer more security by increasing its ability to withstand the financial burden when unusual and major events occur.

A good example of this is a natural disaster like Hurricane Ian. No insurance carrier could shoulder the total cost to rebuild from a storm like that. Reinsurance protects the insured by making sure the insurance carrier remains financially solvent.

Most reinsurance companies are reporting that US results for the last 5 out of 6 years have been poor. With this, reinsurance rates have more than doubled in the last couple of years and we’re seeing data showing that reinsurance rates will continue to increase 25-40% in 2023. One carrier we work with just experienced a 64% increase.

These increases result in a greater cost to the carrier to insure their policies.

REPLACEMENT COSTS

Home insurance is based on the cost to rebuild and replace your home, not its market value.

While market value is the amount your home is worth on the housing market, your home insurance coverage limit is based on the estimated cost to rebuild your home: the cost to repair, rebuild or replace what you had before, using materials of similar type and quality.

Factors affecting rising replacement costs:

- Supply chain disruptions of home materials

- Rising material costs

- Labor supply and demand

- Local Construction Costs

NATURAL DISASTERS

For four of the last six years, carriers continued to experience net underwriting losses, retreat from the catastrophic property market, increase underwriting scrutiny, and shift risk. The monetary cost of natural disasters has an immense impact on the U.S. economy, the primary insurance market, and the homeowners in affected regions. From 2010 to 2020, hurricanes killed an average of 332 people per year and did an average of $47 billion in damage, while wildfires killed an average of 23 people per year and did an average of $7 billion worth of damage per year. In 2022, Hurricane Ian alone, caused an estimated $53B – $74B in insured losses and is poised to deal a far-reaching blow to a shaky property insurance market already facing multiple pressures.

Over the past 50 years, extreme weather events or climate disaster have seen a 5-fold increase with no end in sight. Carriers typically look to past events when making risk calculations, which is why they are now struggling to keep up with the impact of unpredictable, extreme weather events. They continue to adapt their underwriting strategies and develop climate modeling to keep up with the weather events, which negatively impacts their bottom line. In the current hard market, carriers are tasked with managing their financial stability while ensuring the availability and affordability of coverage for their insureds.

This is an industry wide issue with the personal property market being impacted by skyrocketing increases for claims and associated costs including inflation, supply chain issues, and severity of weather related events. There were 20 separate $1 billion + loss events from weather in 2021 alone.

TIPS TO SAVE ON HOMEOWNERS INSURANCE

Below are some steps you can take to potentially lower your insurance premium:

- Increasing Deductibles

- Package Your Policies – Combine Home/Auto/Umbrella

- Adjust Your Coverage Limits

- Reduce or eliminate billing fees – go on EFT or pay in full

- Apply All Eligible Discounts

-

- Central Station Alarm

- Property Improvement

- Smart Water Leak Detector

-