FORMAL ADVISORY: Employee Benefits & Same-Sex Marriage

On June 26, 2013, in United States v. Windsor, the U.S. Supreme Court ruled that Section 3 of the federal Defense of Marriage Act (DOMA) was unconstitutional.

That section of DOMA defined “marriage” and “spouse” as excluding same-sex partners for purposes of determining the meaning of any federal statute, rule or regulation. Prior to the Windsor decision a handful of states and the District of Columbia recognized same-sex marriage. Since the Windsor decision same-sex marriage has either been legislatively approved or court mandated in a majority of the states: as of October 17, 2014, same-sex marriage is considered to be legal in 30 states and the District of Columbia.[1]

Same-sex marriage is effectively legal for federal benefits law purposes and now legal in a majority of states, largely as a result of the U.S. Supreme Court declining to review appeals of lower courts’ decisions banning state “mini-DOMA” laws as a violation of equal protection principles. Benefits and human resources professionals operating companies in the 30 states (and DC) that recognize same-sex marriage all have the same question: what does this mean for their employee benefits plans?

Because of the Windsor decision, the U.S. Department of Labor (DOL) and Internal Revenue Service (IRS) (and most other federal agencies) have indicated that they will consider the term “spouse” to include individuals married to a person of the same sex who were legally married in a state or foreign jurisdiction that recognizes such marriages[2], regardless of whether they reside in a state that does not recognize such marriages (this is known as the “Rule of Celebration”).

For employee health benefits purposes, Windsor is important because it dictates the federal tax treatment and federal rights of employees who receive same-sex spousal benefits.

With respect to fully-insured welfare benefit plans, state law will dictate in all cases. This means that in the 30 states (plus DC) that recognize same-sex marriage, a fully insured health insurance plan that provides benefits to spouses must also offer the same coverage to same-sex spouses.

For self-insured plans, the treatment is not as clear. The Employee Retirement Income Security Act of 1974 (“ERISA”) preempts any state law inasmuch as the state law relates to any benefit plan. This preemption provision does not apply to fully-insured plans, so state law does apply to them (as discussed above). For self-insured plans, there is an argument that a state same-sex marriage law that applies to a self-insured plan would be preempted. However, many practitioners would recommend that an employer in a state that has legalized same-sex marriage that sponsors a self-insured plan consult directly with qualified ERISA counsel to determine whether they can rely on ERISA preemption to avoid being sued by a same-sex married employee. Many practitioners might worry that a law of general applicability like a same-sex marriage law may not be preempted-this would mean that the self-insured plan would be required to offer the same-sex spouse benefits.

For retirement plans like 401(k) plans the IRS has made it clear that the terms “spouse” should be determined using the Rule of Celebration. Again, this means that if an employee and his/her same-sex spouse is married in a jurisdiction that recognizes same-sex marriage, the spouse is recognized for retirement plan purposes regardless of whether the employee lives or works in one of the states that do not recognize same-sex marriage.

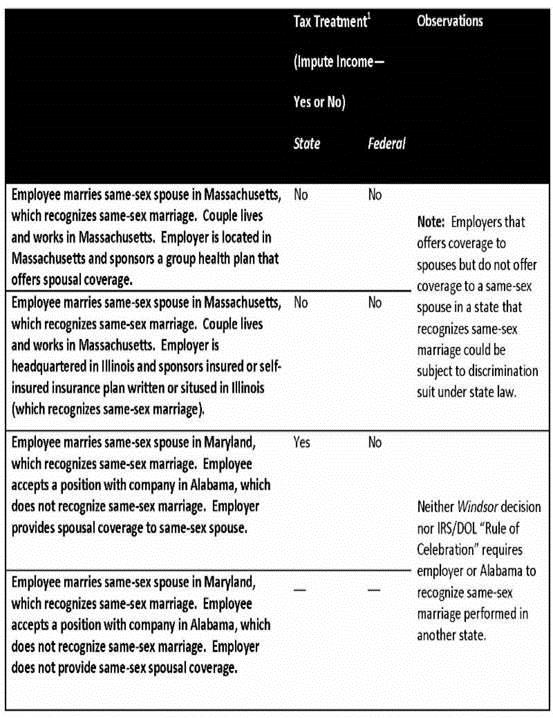

For tax purposes, the Rule of Celebration also applies: employees who are married to a same-sex spouse in a jurisdiction that recognizes same-sex marriages do not have to impute income for the spousal coverage for federal tax purposes even if the employee resides in a state that does not recognize same-sex marriage. However, an employee who is legally married to a same-sex spouse but who lives in one of the states that does not legally recognize same-sex marriage, will have to have the value of the benefit for the spousal coverage imputed into the employee’s income for state income tax purposes, unless the spouse qualifies for “dependent” status under state tax law.

Employers that offer same-sex spousal coverage should not require any greater documentation (marriage certificate, etc.) from same-sex couples than they do from opposite-sex couples.

Finally, the IRS has recently released guidance advising employers to assess whether their “spousal” language in all of their employee benefit plans is consistent with the Rule of Celebration. Amendments, to the extent they are required, generally must be completed by December 31, 2014.

This post is a service to our clients and friends. It is designed only to give general information on the developments actually covered. It is not intended to be a comprehensive summary of recent developments in the law, treat exhaustively the subjects covered, provide legal advice, or render a legal opinion.

[1] As of October 17, 2014, eight states have recognized same-sex marriage through state legislation (Delaware (July 1, 2013), Hawaii (Dec. 2, 2013), Illinois (June 1, 2014), Minnesota (Aug. 1, 2013), New Hampshire (Jan. 1, 2010), New York (July 24, 2011), Rhode Island (Aug. 1, 2013), Vermont (Sep. 1, 2009). Three states have adopted same-sex marriage by popular vote: Maine (Dec. 29, 2012), Maryland (Jan. 1, 2013), Washington (Dec. 9, 2012). 19 states recognize same-sex marriage as a result of court decisions, with most occurring after the Windsor decision: Arizona (Oct. 17, 2014), California (June 28, 2013), Colorado (Oct. 7, 2014), Connecticut (Nov. 12, 2008), Idaho (Oct. 13, 2014), Indiana (Oct. 6, 2014), Iowa (Apr. 24, 2009), Massachusetts (May 17, 2004), Nevada (Oct. 9, 2014), New Jersey (Oct. 21, 2013), New Mexico (Dec. 19, 2013), North Carolina (Oct. 10, 2014), Oklahoma (Oct. 6, 2014), Oregon (May 19, 2014), Pennsylvania (May 20, 2014), Utah (Oct. 6, 2014), Virginia (Oct. 6, 2014), West Virginia (Oct. 9, 2014), Wisconsin (Oct. 6, 2014). DC recognized same-sex marriage on March 3, 2010.

[2] As of September 21, 2013 the following jurisdictions recognize same-sex marriage: California, Connecticut, Delaware, Iowa, Maine, Maryland, Massachusetts, Minnesota, New Hampshire, New York, Rhode Island, Vermont, Washington and Washington, D.C.

[3] Assumes that same-sex spouse is not a dependent of the employee for federal tax purposes. In all instances of imputation, value of the benefit provided is imputed into the income of the employee. Check state revenue laws for proper imputation methodology.